Generally tax deduction is allowed for all outgoings and expenses WHOLLY AND EXCLUSIVELY INCURRED IN THE PRODUCTION OF INCOME. Whether particular outgoings or expenses are deductible is a well-litigated subject and while the scope of this is wide certain principles have emerged from case law.

List Of Tax Deduction For Businesses Cheng Co Group

In Budget 2020 to provide additional flexibility to taxpayers it was.

. It is not a capital expense. Expenses on replacement costs of furnishings. To legislate the above the Income Tax Deduction for Expenses in relation to the Cost of Detection Test of Coronavirus Disease 2019 COVID-19 for Employees Rules 2021 PU.

Tax deduction for cost of listing on Bursa Malaysia. The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production of income during that period. The below are some expenditures generally deductible for tax.

A 404 were gazetted on 20 October 2021. Expenses on rental collection. If the Company incurred the expenses for those road tax motor vehicles insurances repair and maintenance for non-company vehicles such as car belong to salesman these are not deductible for tax purpose unless the Company has declared the benefit-in-kindperquisite in.

A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. You can claim for fees spent on a course of study undertaken in a recognised institution or professional body in Malaysia as listed by the Ministry of Higher Education Malaysia. The Rules provide that in ascertaining a Malaysian-resident employers adjusted income from his business for a year of assessment YA there.

112019 - Benefits In Kinds. Expenses on repairs and maintenance. Road tax motor vehicles insurance repair and maintenance for non-company vehicles.

For those who are doing their Masters or Doctorate degrees any course of study undertaken is eligible. Medical expenses for serious diseases for self spouse or child. Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA.

Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU. Currently companies seeking to list on Bursa Malaysia are not eligible for a tax deduction on listing expenses. Malaysia JSM provided that the expenditure incurred in the relevant period shall be deemed to be incurred by that company in the basis period for the year of assessment in which the certificate is issued 2 Deductible Expenditure Paragraph 5 The Guidelines further elaborate that the deductible expenditure must be specifically incurred.

These tax incentives appear in various forms such as EXEMPTION ON INCOME EXTRA ALLOWANCES ON CAPITAL EXPENDITURE INCURRED DOUBLE DEDUCTION OF EXPENSES SPECIAL DEDUCTION OF EXPENSES PREFERENTIAL TAX TREATMENTS FOR PROMOTED SECTORS EXEMPTION OF IMPORT DUTY AND EXCISE DUTY Malaysia offers a wide range of. However please note that business expenses vary among types of business and industries and IRB may assess based on common industry practices and examine the object of the expenses and their. UNDER SECTION 33 ITA 1967 However please note that business expenses vary among types of business and industries and IRB may assess based on common industry practices and examine the object of the expenses and their.

Outgoings and Expenses. Types of vaccine which qualify for deduction are as follows. Expenses on free meals refreshment annual dinners outings corporate family day or club membership for staff.

The sponsor is allowed for 50 deduction because the expenses does not fall within any of the specified categories in provisos i to viii of paragraph 391I of ITA 1967. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. Property Rental Income.

Under section 131 b Income Tax 1967 medical and dental benefits are exempted from income tax for employees. As such it is very important as an investor of your real property to learn and take advantage of the. Entertainment Expense which Qualifies for a Fifty Percent 50 Deduction.

Entertainment expenses in having ordinary course of business. Generally tax deduction is allowed for all outgoings and expenses wholly and exclusively incurred in the production of income. As we used to say staff are assets and therefore the expenses are tax deductible.

Expenses on rental renewal including the stamp duty. Public Ruling 42015 paragraph 8 Public Ruling 42015. Vaccination expenses for self spouse and child.

Firstly the outgoings and expenses referred to by section 33 must strictly speaking be revenue in nature ie. Is directors medical expense tax-deductible in Malaysia. Medical expenses for fertility treatment for self or spouse.

Rental Income Deductible Expenses. In Malaysia rental income that you received from your real property such as serviced apartment condominium flat shophouses industrial properties commercial office etc is taxable under the Income Tax Act 1967. In Budget 2020 to assist technology-based companies and SMEs that raise additional capital through listing on the Access Certainty Efficiency ACE Market or Leading Entrepreneur Accelerator Platform LEAP.

The legislation dealing with the general deduction is stated in Section 331 of the ITA. Here is a list of common allowable items. Rent expenses of business premises repair and maintenance of premises plant and machinery loan interest or borrowing cost subject to interest deduction restriction employee salaries allowance and statutory contribution stock in trade refer to sec 35 and many more.

The expenses that are income tax deductible including.

Tax Treatment On Entertainment Expenses Asq

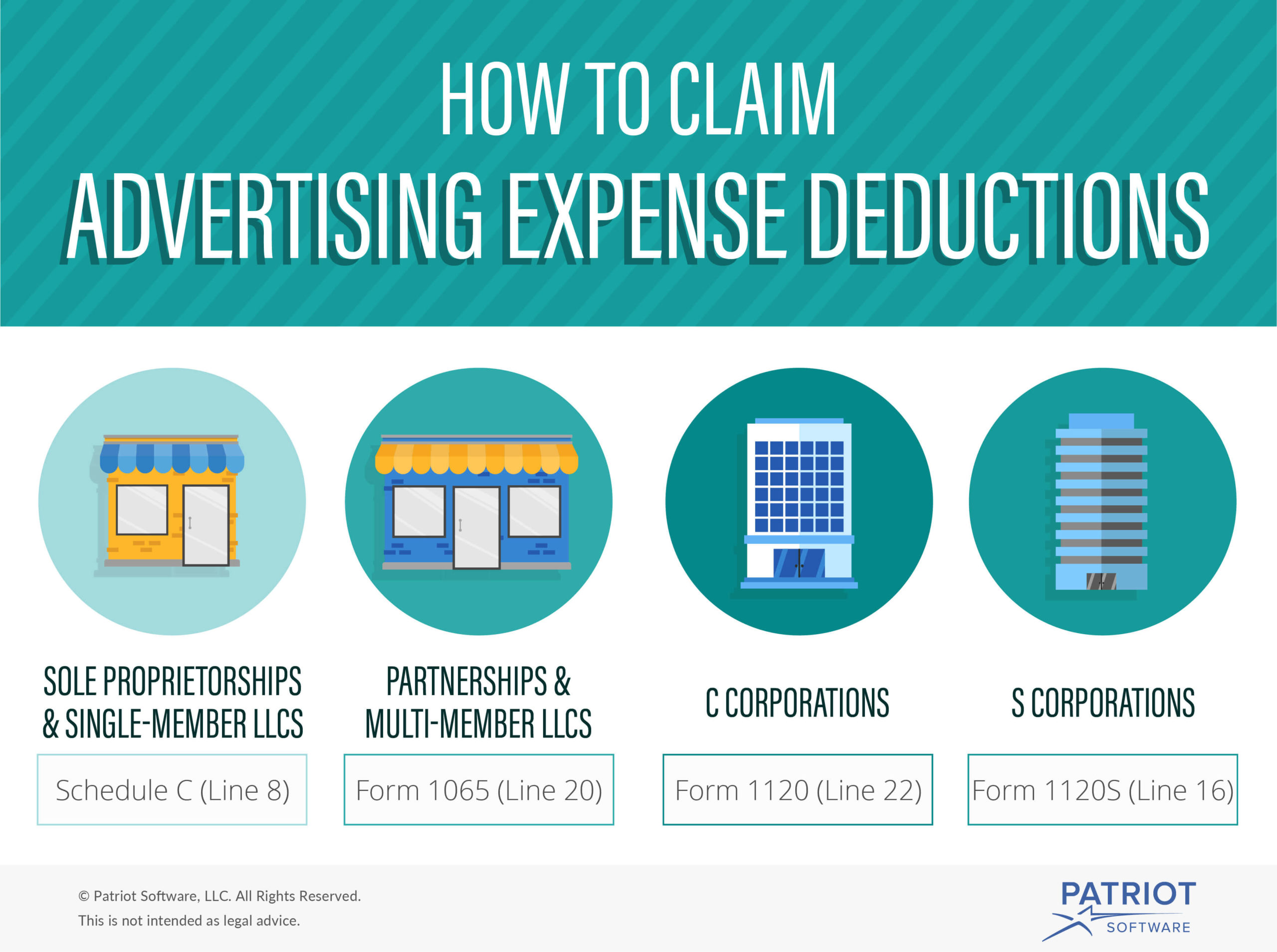

Advertising And Promotion Expenses How To Deduct For Your Business

Five Common Questions To Ask Yourself About Tax Deductible Expenses

12 Month Rule For Prepaid Expenses Overview Examples

Tax Treatment For Entertainment Expenses

Free Bookkeeping Guide Made Easy For Beginners

What Are Non Deductible Expenses Rydoo

Tax Treatment On Entertainment Expenses Asq

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran

T Glide Files How To Retrieve And Insert Filing System Accounting Office Office Filing System

Meals Entertainment Deductions For 2021 2022

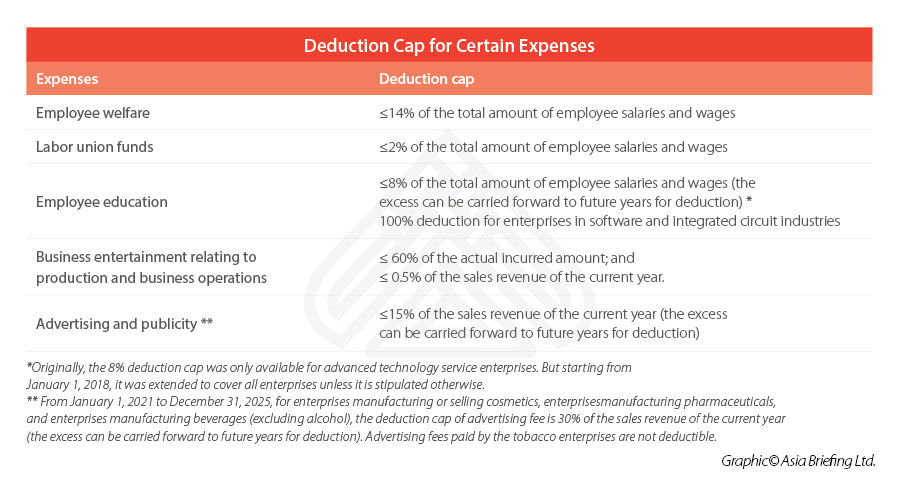

China Extends Pretax Deductions For Advertising Expenses By 5 Years

How To Deduct Medical Expenses On Your Taxes Smartasset

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-05-0a18b601c53e44e29084a0b778b79723.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Switch To Freshbooks In May To Track Business Expenses The Easy Way Freshbooks Blog

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Tax Treatment On Entertainment Expenses Asq

Cash Flow Projection Worksheet